and Wellness

YOUR PROGRAM

PRO $ PER™

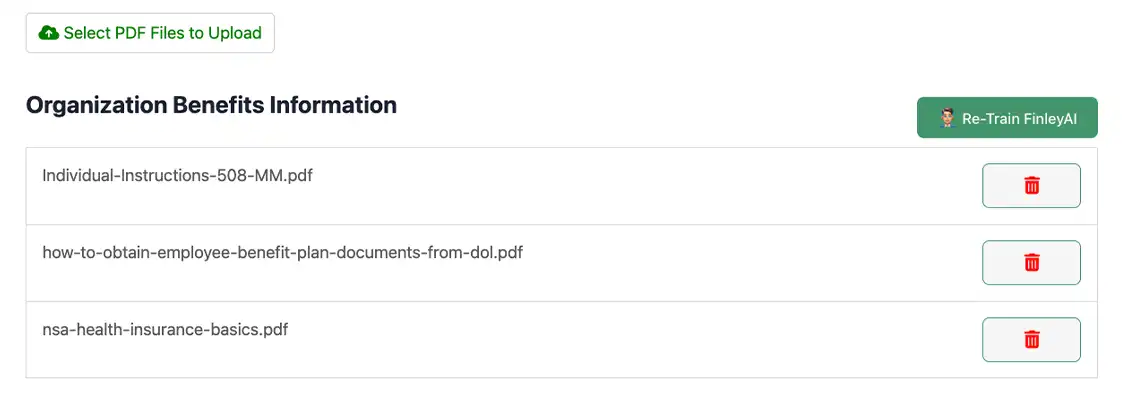

PRO$PER™ (EAP) is not just a name—it's a commitment to a transformative journey toward financial literacy for all employees. From the fundamental shifts in mindset, to reducing debt, benefit analysis and creating financial security, PRO$PER™ (EAP) takes a comprehensive approach to financial education.